|

Issuer:

|

KKR & Co. Inc.

|

|

Initial Guarantor:

|

KKR Group Partnership L.P.

|

|

Securities:

|

6.875% Subordinated Notes due 2065 (the “notes”)

|

|

Ranking:

|

Subordinated

|

|

Principal Amount Offered:

|

$550,000,000

|

|

Over-Allotment Option:

|

$82,500,000

|

|

Trade Date:

|

May 20, 2025

|

|

Settlement Date*:

|

May 28, 2025 (T+5)

|

|

Maturity Date:

|

June 1, 2065

|

|

Coupon:

|

6.875%

|

|

Underwriting Discount:

|

$0.7875 per subordinated note sold to retail investors and $0.5000 per subordinated note sold to institutional investors

|

|

Price to Public:

|

$25.00 per subordinated note plus accrued interest, if any, from May 28, 2025 to the date of delivery.

|

|

Interest Payment Dates:

|

March 1, June 1, September 1 and December 1 of each year, commencing on September 1, 2025.

|

|

Record Dates:

|

Interest payments on the notes will be made to the holders of record at the close of business on February 15, May 15, August 15 or November 15, as the case may be, immediately preceding such March 1, June 1, September 1 and December 1,

whether or not a business day.

|

|

Optional Interest Deferral:

|

The Issuer has the right on one or more occasions to defer the payment of interest on the notes for up to five consecutive years (each such period, an “optional deferral period”). During an optional deferral period, interest will continue

to accrue at the interest rate on the notes, compounded quarterly as of each interest payment date to the extent permitted by applicable law.

|

|

Optional Redemption:

|

The Issuer may elect to redeem the notes:

•

in whole at any time or in part from time to time on or after June 1, 2030,

at a redemption price equal to their principal amount plus accrued and unpaid interest to, but excluding, the date of redemption; provided that

if the notes are not redeemed in whole, at least $25 million aggregate principal amount of the notes must remain outstanding after giving effect to such redemption;

•

in whole, but not in part, within 120 days of the occurrence of a “Tax Redemption Event”, at a redemption price equal to their principal amount plus

accrued and unpaid interest to, but excluding, the date of redemption; or

•

in whole, but not in part, at any time prior to June 1, 2030, within 90 days

after the occurrence of a “rating agency event” at a redemption price equal to 102% of their principal amount plus any accrued and unpaid interest to, but excluding, the date of redemption.

|

|

Day Count/Business Day Convention:

|

30/360 Following, Unadjusted

|

|

Gross Proceeds (before expenses and underwriting discount):

|

$550,000,000

|

|

Denominations:

|

$25 and integral multiples of $25 in excess thereof.

|

|

Expected Ratings**:

|

S&P: BBB+ / Fitch: BBB+

|

|

CUSIP / ISIN:

|

48251W 609 / US48251W6093

|

|

Joint Book-Running Managers:

|

Wells Fargo Securities, LLC

BofA Securities, Inc.

J.P. Morgan Securities LLC

Morgan Stanley & Co. LLC

UBS Securities LLC

KKR Capital Markets LLC

|

|

Co-Managers:

|

AmeriVet Securities, Inc.

Barclays Capital Inc.

Blaylock Van, LLC

BMO Capital Markets Corp.

BNP Paribas Securities Corp.

BNY Mellon Capital Markets, LLC

CastleOak Securities, L.P.

CIBC World Markets Corp.

Citigroup Global Markets Inc.

Credit Agricole Securities (USA) Inc.

Goldman Sachs & Co. LLC

HSBC Securities (USA) Inc.

ING Financial Markets LLC.

Loop Capital Markets LLC.

Mizuho Securities USA LLC

R. Seelaus & Co., LLC

Samuel A. Ramirez & Company, Inc.

RBC Capital Markets, LLC

Roberts & Ryan, Inc.

Santander US Capital Markets LLC

Scotia Capital (USA) Inc.

SMBC Nikko Securities America, Inc.

SG Americas Securities, LLC

Standard Chartered Bank

Strong Capital Markets, LLC

TD Securities (USA) LLC

Truist Securities, Inc.

U.S. Bancorp Investments, Inc.

|

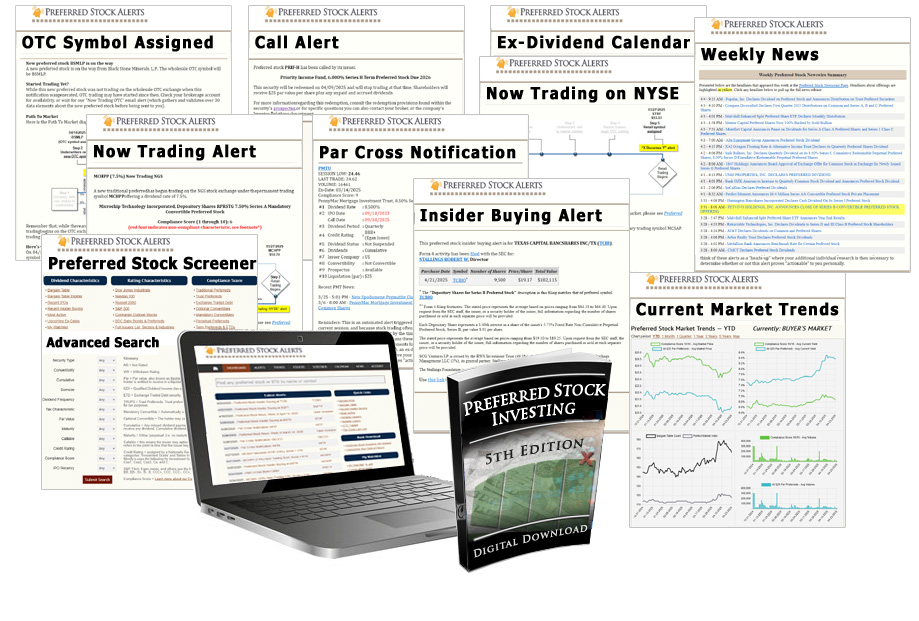

Learn How To Unlock Consistent Income with Preferred Stocks

Dear Reader,

Common stocks can be a wonderful investment, but the volatility can be astonishing. Pull up almost any popular stock quote, and notice the massive difference between the 52-week low trading price and the 52-week high.

That difference can be simply jaw-dropping.

Sure, it would be wonderful if the movement from low to high happened in smooth steps, but the true ride investors take, is more like a roller coaster.

And that's part of the appeal of preferred stocks: reduced volatility. Preferred stocks rank senior to common stock in a company's capital structure — that means enhanced safety. Combine that with regular income that is often far stronger and steadier.

But approaching the universe of preferred stocks can be daunting.

- What are the important elements to consider?

- How does one find quality preferred stocks?

- How does one keep informed about new offerings?

Enter Preferred Stock Alerts.

Preferred Stock Alerts helps you navigate the preferred stock market with confidence. No more digging through SEC filings and out-of-date websites.

Instead, you'll keep up-to-date on new IPOs with timely email alerts. You'll get a heads-up about trading opportunities, with par cross notifications and insider buying alerts.

Our screening tools make it easy to explore our comprehensive database of preferred stocks (and exchange traded debt securities — aka "baby bonds").

Our ten-element preferred stock selection criteria focus on factors such as dividend strength, call protection, and creditworthiness. We do all the work of "scoring" for you, with a handy compliance score given to each preferred stock. This helps you more easily find higher yields at lower risk.

You'll have access to highly useful research resources, including a download of the 300+ page book Preferred Stock Investing (5th Edition). This book teaches the critical 10-element selection criteria for preferreds and baby bonds that form the heart of our service.

Here's everything available to help you build your high-yield portfolio:

Email Alerts: Stay Informed

- Pick and choose the alert types you want to receive

- Access alerts by email or online dashboard

- Be among the first to know about new issues (initial public offerings)

- Get notified about preferred stock insider buying activity

- Receive par cross alerts for high-scoring securities

- Detailed IPO Spec Sheets and prospectus information

- Risk characteristics: credit ratings, cumulative/non, and our "compliance score"

- All U.S. exchanges, even the wholesale OTC

Preferred Stock Database: Research With Ease

- US-traded preferred stocks: traditional, trust, 3rd-party trust

- Exchange traded debt securities (ETDs aka "baby bonds")

- Toggle available data columns on and off as desired

- Current trading data (last trade price, volume, yield)

- Ex-dividend calendar for upcoming payers

- Qualified Dividend Income (QDI) designation

- Lists of securities issued (or acquired by) a specific company

Screener & Search Engine: Discover New Ideas

- Dozens of one-click screens, like S&P 500-issued, and BDC Baby Bonds

- "The Bargain Table" featuring noteworthy scorers, trading below par

- Screen by sector and industry

- Advanced search tool with a dozen searchable characteristics

- Dozens of sortable characteristics

- Monthly dividend paying preferred stocks and baby bonds

- Create personalized watchlists

Research Resources: Continue Learning

- Download the 300+ page book Preferred Stock Investing (5th Edition)

- Preferred stock market trend charts and indicators

- Weekly newsletter with preferred stock news and par cross summary

- Return calculators: current yield, yield-to-call, effective annual return

- Newswire featuring preferred stock dividend declarations and offerings

- Lists of issuers, including by sector and industry

- Notable "big gainers" and "losers" along with "most active"

- Preferreds with recent insider buying activity

How to Try Preferred Stock Alerts FREE for 30 Days

For well over a decade, our notification service has offered no free trial period to the public. But right now, we're giving you the opportunity to enjoy a 100% FREE trial for the first 30 days.

That means you can sign up today and take it for a test drive for a full month, after which you will be charged a nominal $29.95 each month for as long as you remain enrolled in the service. You can call or email our New York office to cancel at any time, no questions asked.

>>>>> Start My 1 Month FREE TRIAL: <<<<<

Preferred Stock Alerts, Preferred Stock List © BNK Invest, Inc. – All Rights Reserved – Legal Information